Sello Motseta

7th January 2025

The Bank of Botswana has announced the revision of the prevailing Pula currency basket weights of 45% for the South African rand and 55% for the Special Drawing Right (SDR) comprising the US dollar, Euro, British Pound, Japanese Yen and Chinese Renminbi.

It will now be weighted 50% to the South African Rand and 50% to the SDR, in an effort to moderate the volatility of the Pula against the South African rand and promote the competitiveness of domestic goods and services in the South African market, a close and important trading partner.

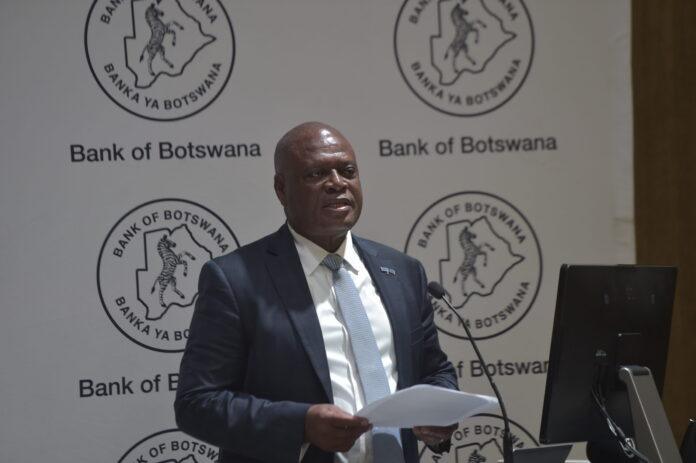

Central Bank Deputy Governor Kealeboga S Masalila, said “We have since 2005 done away with occasional discrete devaluations and revaluations of the Pula; so, there has been no devaluation this time. Indeed, there has been no noticeable change in the exchange rate of the Pula against any currency between 31st December and today; a devaluation would immediately show up as a significant change in the exchange rate.”

He said, “Two, the exchange rate policy parameters are important for price competitiveness of local producers and service providers and there should be policy safeguards/guardrails and responses to promote industrialization, diversification and economic growth.”

Masalila stressed that there should be producers and service providers in Botswana that earn foreign exchange, that is, sell in rands, US dollar, euro, British pounds, and so forth, so that there is foreign currency available for those that import to be able to pay in the respective currencies.

“Ultimately, the capability to earn foreign exchange/foreign currency, and the demand for imports, determine where you can place the value of the Pula, if not determined by the market. Hitherto, diamond exports have been doing the heavy lifting of availing foreign exchange currency for imports,” said Masalila.

He said, “This appears to have moderated and subject to large fluctuations, hence the need to incentivize and promote other exports of Botswana products and services.”

Officials maintain the focus is on measured, but pre-emptive adjustments – that is, intended to avoid transition or slide to misalignments and instability that would require aggressive policy responses that could themselves be destabilizing and negative for welfare.

To contextualize their decision officials revealed that there was a 7.5 percent Pula devaluation in 2004 as a competitiveness measure and crawling peg mechanism was adopted in May 2005. Officials revealed that there was a 12 percent Pula devaluation in 2005 (before crawling peg was introduced).